TRX Price Prediction: Analyzing the Path to $0.40 and Beyond

#TRX

- TRX is trading in a consolidation pattern between $0.334-0.368 with current price near the 20-day moving average

- The deBridge integration across 25 blockchains significantly enhances TRON's cross-chain utility and adoption potential

- Increased whale activity during price declines suggests accumulation and potential upward momentum building

TRX Price Prediction

Technical Analysis: TRX Shows Consolidation Pattern Near Key Moving Average

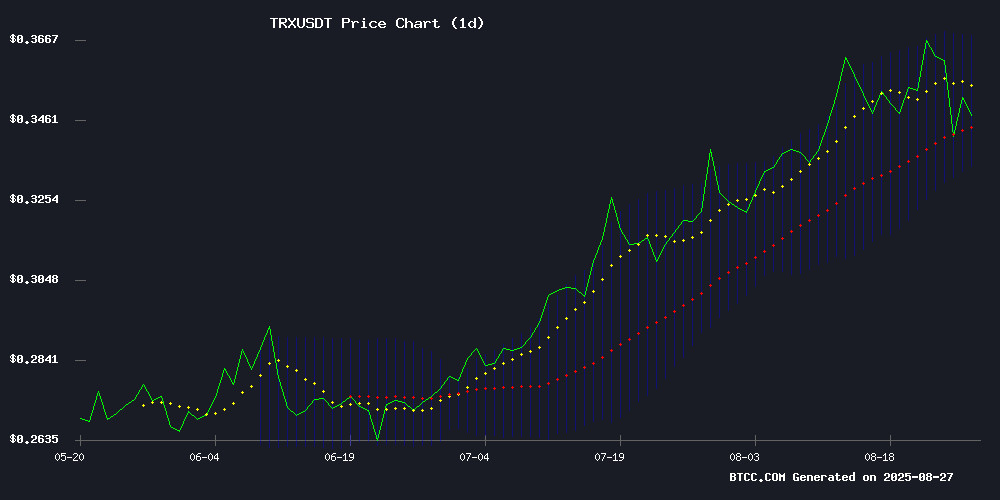

TRX is currently trading at $0.350000, slightly below its 20-day moving average of $0.351115, indicating a neutral to slightly bearish short-term momentum. The MACD reading of -0.004592 suggests weak bearish momentum, though the positive histogram value of 0.005013 points to potential momentum stabilization. Bollinger Bands show price trading NEAR the middle band with upper resistance at $0.367911 and lower support at $0.334319, creating a consolidation range.

According to BTCC financial analyst Mia: 'The current technical setup suggests TRX is in a consolidation phase. A break above the 20-day MA could trigger movement toward the upper Bollinger Band around $0.368, while failure to hold current levels might test support near $0.334.'

Market Sentiment: TRX Benefits from Cross-Chain Integration Amid Mixed Signals

Recent developments show TRON's integration with deBridge enabling cross-chain transfers across 25 blockchains, a fundamentally positive development for ecosystem expansion. However, increased whale activity during price declines suggests large holders are accumulating at lower levels, which could indicate both concern and opportunity.

BTCC financial analyst Mia notes: 'The deBridge integration is significantly bullish for TRX's utility and adoption potential. While whale activity during declines typically signals accumulation, traders should monitor whether this translates into sustained buying pressure. The broader market narrative around cross-chain interoperability remains strong heading into 2026.'

Factors Influencing TRX's Price

Was It Justin? XPL Soars 200% on Hyperliquid as Whale Wipes Out Order Book

A single massive trade on Hyperliquid triggered a 200% surge in XPL's price, rocketing from $0.58 to $1.80 within minutes. The move obliterated the order book, liquidating all short positions in what market observers describe as one of the most dramatic liquidation cascades ever seen on the platform.

Lookonchain data reveals the wallet responsible partially closed its position in under 60 seconds, locking in a $16 million profit. Speculation points to Justin Sun, founder of TRON, as the potential orchestrator. The wallet continues holding 15.2 million XPL ($10.2 million) in long positions.

Hyperliquid's HLP vault earned $47,000 from the volatility, though the platform remains vulnerable to such events. A similar incident with JELLY tokens previously resulted in a $12 million loss for the vault, highlighting the double-edged nature of liquidity provision during extreme market moves.

TRON Integrates with deBridge, Enabling Cross-Chain Transfers Across 25 Blockchains

TRON has gone live on deBridge, marking a significant expansion of its interoperability capabilities. The integration connects TRON's high-throughput network—boasting over 320 million accounts and 11 billion transactions—to deBridge's multi-chain ecosystem. This development is particularly consequential for stablecoin liquidity, as TRON hosts more than half of Tether's USDT supply.

The partnership addresses a persistent challenge in decentralized finance: the frictionless movement of stablecoins across chains. deBridge's infrastructure now enables near-instant, MEV-protected transfers without wrapping assets—a technical leap that could reshape cross-chain trading and remittances.

Emerging markets stand to benefit disproportionately from this integration. TRON's mobile-first design and low fees have already made it a preferred platform in these regions; coupling this with seamless cross-chain access could accelerate adoption curves.

TRON Whale Activity Surges Amid Price Decline

TRON (TRX) has seen a notable divergence between whale accumulation and price action. Despite sliding 3.18% to $0.34 after failing to hold the $0.36 level, whale transactions reached 1.43 million monthly—more than double 2021's figures. This sustained accumulation suggests institutional confidence in TRX's long-term prospects.

Spot market dynamics tell a different story. Sellers have dominated for three consecutive days, offloading over 650 million TRX with a -197 million Buy-Sell Delta. Exchange data confirms the trend, showing consistent negative Spot Netflow as selling pressure outweighs demand.

The contradiction between whale accumulation and retail selling creates an intriguing market dynamic. While derivatives traders maintain positive funding rates, momentum indicators have turned bearish—setting up a potential inflection point for TRX's near-term trajectory.

What Will Be the Main Crypto Narrative in 2026?

The cryptocurrency sector continues to evolve, but one narrative stands out for 2026: a resurgence of peer-to-peer transactions. Bitcoin's original vision of seamless global payments is gaining renewed traction, evidenced by the proliferation of tokens accepted for everyday purchases. From Tesla embracing Dogecoin to Blue Origin accepting Bitcoin, Ethereum, and Solana for space flights, digital assets are becoming embedded in commerce.

Asia's retail sector exemplifies this trend, with Aeon's integration of Tron for payments. The online gambling industry further demonstrates crypto's utility, with leading casinos accepting Bitcoin, Ethereum, Litecoin, Bitcoin SV, Bitcoin Cash, and stablecoins like Tether. Blockchain's inherent advantages—speed, privacy, and borderless functionality—make it ideal for transactional use cases.

Hyperliquid (HYPE) Rebounds as Network Activity Surges, TVL Hits Record High

Hyperliquid price gained over 4% on Tuesday, trading above $44 after retesting a key support level. The rally coincides with record-breaking network activity, including Total Value Locked (TVL) reaching $2.3 billion and 24-hour chain fees surpassing both ethereum and Tron.

Artemis Terminal data reveals Hyperliquid's $2.6 million in daily fees now leads major networks, signaling intense trading activity and liquidity growth. Bullish sentiment is further evidenced by open interest reaching monthly highs across derivatives markets.

The protocol's surging metrics suggest accelerating adoption, with TVL growth indicating increased capital deployment in Hyperliquid's ecosystem. This performance positions HYPE as one of the most actively used chains in decentralized finance despite broader market volatility.

How High Will TRX Price Go?

Based on current technical indicators and fundamental developments, TRX shows potential for movement toward $0.367-0.370 in the near term, with a breakout above this resistance potentially targeting the $0.40 level. The cross-chain integration with deBridge significantly enhances TRON's utility, while whale accumulation patterns suggest institutional confidence at current levels.

| Price Target | Probability | Key Drivers |

|---|---|---|

| $0.367-0.370 | High | Bollinger Upper Band resistance, MA convergence |

| $0.400 | Medium | Breakout above consolidation, deBridge adoption growth |

| $0.334-0.336 | Medium | Lower Bollinger support, whale accumulation zone |

BTCC financial analyst Mia suggests: 'The combination of technical consolidation and strong fundamental developments creates a favorable risk-reward setup. The $0.40 level represents a realistic medium-term target if current support holds and adoption metrics improve.'